ST. PETERSBURG — The public will have an opportunity to see and weigh in on the four proposals for the redevelopment of the 86-acre Tropicana Field site during sessions this week.

All of the proposals address the requirements the city laid out in its solicitation for bids last year. All imagine homes, offices, tourism, education and retail coexisting. All leave space for a ballpark should the Tampa Bay Rays ultimately want to develop another stadium on the site, while making accommodations for parkland, revitalizing Booker Creek, incorporating the site’s racial history and providing for sustainability and arts and culture. The differences are in the details, broken down below by each proposal. Mayor Rick Kriseman could make his final selection as soon as May.

Petersburg Park: ‘The soul of the city’

Developer: Unicorp National Developments, Orlando

Cost: $643 million; potentially $1 billion more with a stadium. Unicorp would ask the city for $100 million in tax increment financing — a municipal funding option relying on future property tax increases — mostly for parks and public spaces.

Residences/affordable housing: 2,995 with a stadium, 3,448 without. Affordable housing was not specified but will be “integrated seamlessly … rendering it indistinguishable from other products in the plan.”

Office square feet: 155,000, plus up to 186,000 of flex space

Retail square feet: 235,000 with a stadium, 312,000 without

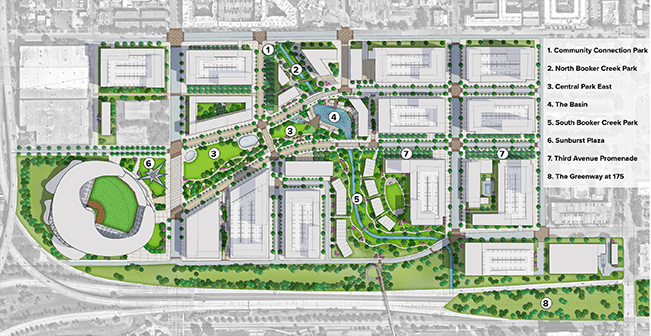

Parks and greenspace: Thirty-six acres of greenspace would stem outward from an expanded Booker Creek; features could include a bandshell, skating rink and putting green. A pedestrian bridge would link Petersburg Park to Campbell Park just south of Interstate 175.

Stadium: Unicorp proposes a smaller, 25,000-seat park with greenspace beyond the centerfield wall, so the stadium could “act more like an amphitheater for outdoor concerts and special events.”

Hotels and conference space: A 400-room hotel with 66,000 to 70,000 square feet of conference space.

Research and higher education: The plan calls for a 288,000-square-foot “innovation district” and states several colleges and universities have shown interest in satellite campuses.

Inclusiveness, equality and racial history: The plan aims to “begin healing the scars of the past by bringing back a community fabric.” Developers would host meetings “to have direct and meaningful involvement with the surrounding population.”

Arts and culture: Public art and a bandshell

•••

The detail Unicorp’s Chuck Whittall likes to point out: A roller skating rink.

“A lot of northern cities have great ice skating rinks, and obviously, with our climate, we can’t,” Whittall said. “But back in the day when I was a kid, roller skating was real big. We thought to have an outdoor roller skating rink would be really cool. What a great place to go on a nice Saturday, take your kids, go skating around out there, and be able to get a smoothie. You can start to feel it just with me saying it.”

Unicorp’s 206-page proposal, dubbed Petersburg Park, includes 36 acres of park and open space. That isn’t much more than the others. But of the four bids, Unicorp’s has the least amount of dedicated office and retail space. Even if the city asks for more business opportunities, he believes the public will rally behind a greenspace-forward approach.

“Look at New York’s Central Park,” Whittall said. “It’s not the highest and best use for that piece of land, but it’s the highest and best use for the entire community, because it gives the community a park, which uplifts home values in general, and it gives everybody a place to go.”

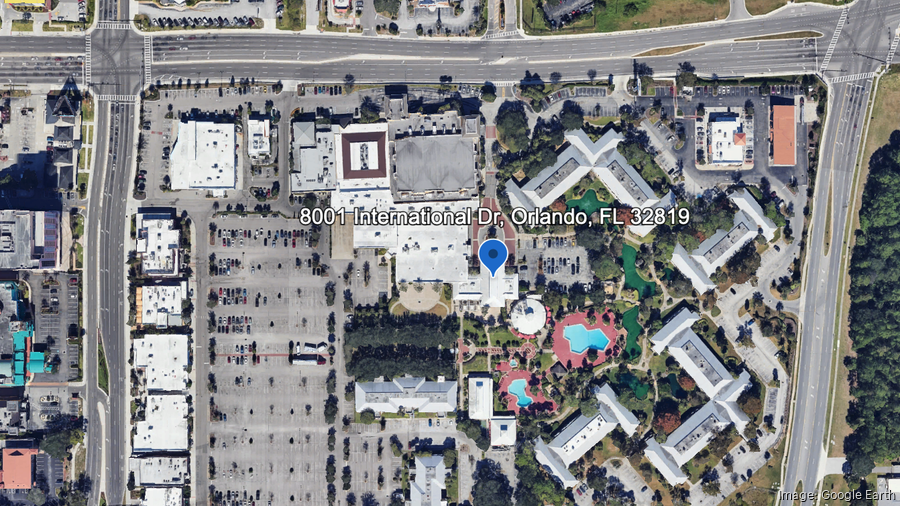

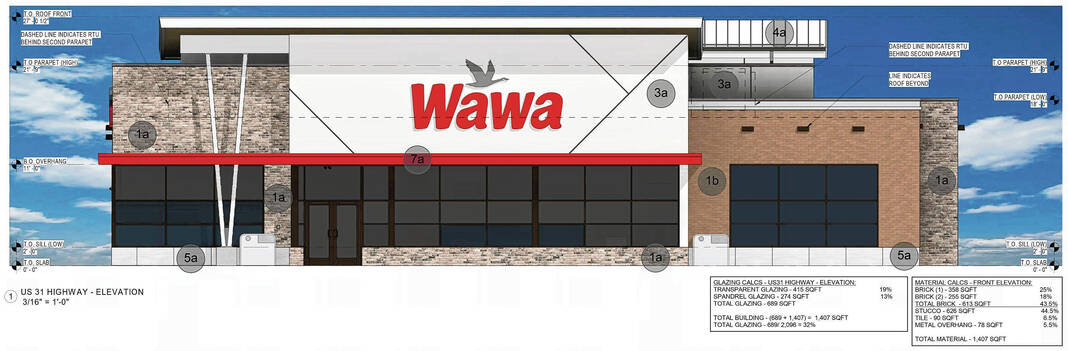

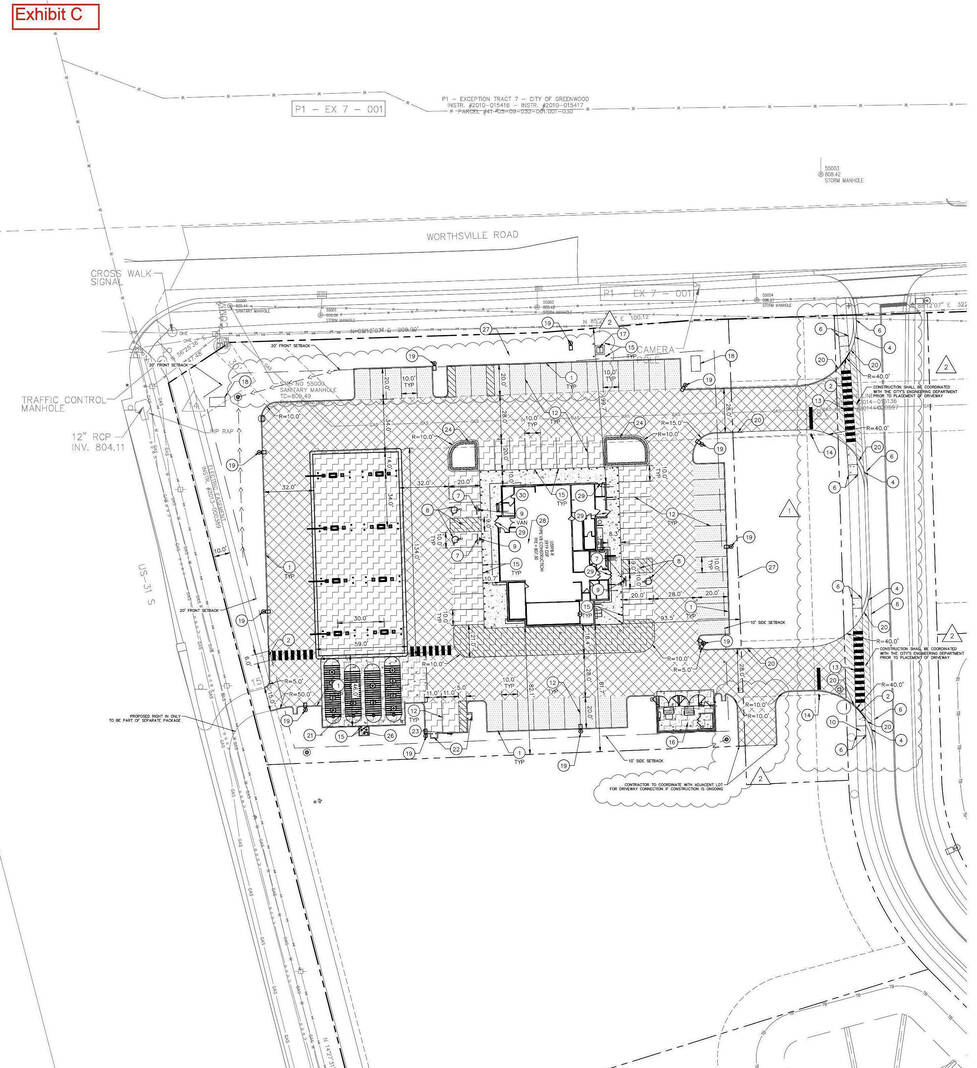

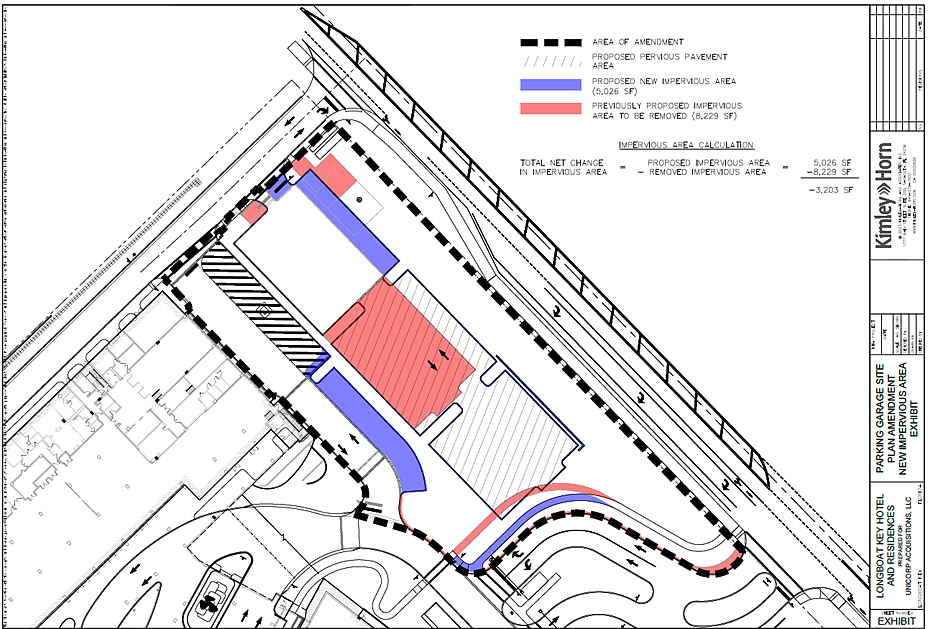

Unicorp’s portfolio of past and future projects reflects its experiential approach: A $1 billion mixed-use project called O-Town West near Walt Disney World; a $1 billion renovation of Orlando’s Fashion Square Mall; Orlando’s ICON Park and its 400-foot Ferris wheel; and a $600-million hotel-condo project on Longboat Key.

Whittall called Unicorp a “full-service turnkey developer,” capable of leading most aspects on its own, rather than relying on investors or farming tasks out to other teams.

“We’re not trying to leverage it for the highest return on investment,” he said. “Yes, we’ll make a profit off it, of course, but we’re not hostage to an investment committee or anybody who says what type of return they’ve got to make. … That gives us the flexibility to deliver something a little bit more special.”

Creating a space built with the public in mind, he said, is the best way to bridge the site’s fraught history with the city’s vision of unity.

“We really want to make something that’s for everyone, something that benefits the entire community, not just a sector,” he said. “Parks don’t discriminate. Anybody can go there, anybody can play.”

Portman/Third Lake: ‘A new central core for St. Petersburg

Developers: Portman Holdings and Portman Residential, Atlanta; Third Lake Partners, St. Petersburg

Cost: $2.6 billion without a stadium, $2.3 billion with one — with a catch. The non-ballpark estimate excluded the cost of stadium demolition or construction due to “uncertainty surrounding the ownership and financing.” Developers would request at least $75 million in tax increment financing, largely for stadium demolition and environmental remediation. A stadium and convention center also may require public funding.

Residences/affordable housing: 3,540 with a stadium; 3,910 without. Affordable housing was not specified but will be “based on a variety of income levels” and “interspersed throughout the site.”

Office square feet: 1.95 million with a stadium; 2.4 million without

Retail square feet: 305,000, plus 13,000 of cultural space

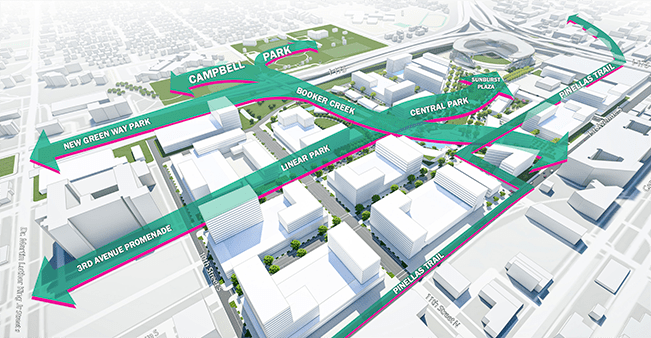

Parks and greenspace: Nearly 36 acres of open or greenspace stemming from a network of trails around Booker Creek, with “enhanced connections” to Campbell Park and Roser Park.

Stadium: Developers estimate a 30,000-seat stadium could cost $825 million but encourage the city to explore relocating to the Al Lang Stadium site and are “prepared to discuss this possibility further.”

Hotels and conference space: One 400-room hotel with 50,000 square feet of meeting space.

Research and higher education: 348,000 square feet of institutional space for a research, educational or healthcare campus.

Inclusiveness, equality and racial history: Historical murals and markers would note the history of the former Gas Plant district, “once a thriving community of black-owned businesses, churches and equitable housing.” The plan also promises to support “generational job creation” with “cradle-to-career programs” aimed at “disenfranchised populations,” with an emphasis on the Black community.

Arts and culture: Third Avenue S would become an “arts corridor” linking downtown and the Warehouse Arts District. If a new stadium is not needed, that space would be turned into a “creative arts hub” with a focus on “small businesses, creative industries and specialized manufacturing.”

•••

Ken Jones remembers watching Billy Joel play the first concert held at what is now Tropicana Field. That was three decades ago. If it takes another decade or two to raze the Trop and start over, he’s willing to wait.

“If you’re an out-of-town developer, or someone that’s not living and working in this community every day, you don’t have the same vested interest,” said Jones. “If this thing takes 20 years, or however long it takes, that’s fine with us, because we’re going to be here for that long.”

Jones is the CEO of Third Lake Partners, which along with Atlanta’s Portman Holdings and Portman Real Estate is backing a site proposal costing between $2.3 billion and $2.6 billion.

While the Portman-Third Lake plan isn’t the only one with local partners, it might be the one most intertwined with local politics.

Third Lake Partners — whose primary investors are the Wanek family, owners of Ashley Furniture — recently won another high-profile city bid to redevelop St. Petersburg’s Municipal Services Center and build a new one a few blocks away. Another partner in the proposal, Darryl LeClair, spent years lobbying the city to let the Rays explore a stadium site at his Echelon City Center in the Carillon area.

And Jones has been a major player in local, state and national politics. After years in Washington, D.C., he served as CEO of the host committee for the 2012 Republican National Convention in Tampa. He was recently appointed to the state’s Board of Governors, which oversees Florida’s universities.

Jones also served on the executive committee of the Rays 100, a team-supported group of civic leaders tapped to explore a move from St. Petersburg to Ybor City. The team has stayed mum on the future of the Trop site, but Jones said his Rays 100 experience factored into his group’s bid.

“Understanding how many seats should a stadium have, should it be a dome, should it be open-air, should it be publicly accessible when the Rays aren’t playing baseball — that was a big part of the discussion,” he said. “All those things were discussed in great detail about the Ybor City site.”

If the Rays choose not to stay on the site, Portman-Third Lake proposed reigniting discussions about a new stadium on the site of Al Lang Field, home of the Tampa Bay Rowdies. It also proposed creating an arts hub where the stadium sits now.

Jones said his team’s plan will evolve as the city and its residents decide what they like, don’t like and want to see more of.

“I think our plan is comprehensive, and it’s thoughtfully comprehensive, in that we’re not trying to create a concrete jungle,” he said. “You want to have some imagination in the proposal, like, ‘This is the art of the possible,’ and then you want to fill it in based on feedback you get along the way.”

Creekside: ‘The future of St. Petersburg’

Developer: Midtown Development, Miami

Cost: $2.7 billion to $3.8 billion, depending on density. Midtown would buy the property from the city for $60 million, which will come in installments. The first will be $10 million at closing. Midtown also committed to spending at least $94 million on public improvements. It requests no more than $75 million in tax-increment financing from the city for infrastructure. Stadium costs did not factor into Midtown’s estimates.

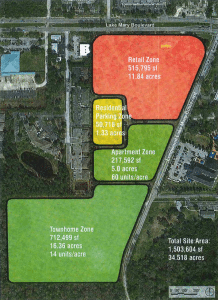

Residences/affordable housing: 6,000 to 8,000 residential units, with conflicting references to those in “affordable and workplace” price ranges. At one point, it says at least 20 percent of those totals would be affordable; elsewhere, it says 1,000 units would be.

Office square feet: Between 3.3 million and 3.95 million square feet, depending on density.

Retail square feet: From 300,000 to 400,000 square feet of “small-box artisan spaces and galleries.”

Parks and greenspace: Thirty-six acres of “public realm” space, including 24 acres dedicated to parks, a piazza and Booker Creek, plus terraces, boardwalks and a dog park. Midtown promised to devote $30 million to public parks.

Stadium: Midtown’s development timeline reserves the land between Booker Creek and 16th Street for the Rays, should they choose to stay.

Hotels and conference space: One 510-room hotel and 50,000-square-foot conference center.

Research and higher education: An “Innovation Campus” and “Grow Smarter Corporate complex.”

Inclusiveness, equality and racial history: Midtown plans a 1.5-mile “Heritage Trail” and has pledged $1 million to seed an education, jobs and equal justice nonprofit. The 16th Street corridor will be enhanced to a “main street” to make a more appealing connection with the neighborhood to the south, and a park

bridge, called the Greenway, will connect the property to Campbell Park.

Arts and culture: The plan pitches a partnership with Studio@620 and promises to “exceed all funding and initiatives in this realm,” plus an arts park under Interstate 275.

•••

When designing the Midtown Development proposal, lead architect Randy Morton started with Booker Creek, flowing diagonally along the city’s street grid, like Broadway angles through Manhattan.

“The geometry of the creek means when you’re on this site, you’re in an environment that won’t be found anywhere else in St Petersburg, because the funny angle of the creek means that our streets are going to bend,” said Morton, founder of Pinstripe Design and Advisory Group, noting that makes the entire nature of the development more pedestrian friendly.

The creek, with its grade below street level allowing for a sunken river scene, will be expanded into several basins up to 150 feet wide, to create islands connected by walkways and to collect its own runoff. It’ll swoop south toward the Greenway — another central feature of the design — a grassy pedestrian bridge over Interstate 175 that will connect with Campbell Park.

“Moving from up to down is where all the fun is,” Morton said, adding that there could be winding staircases, slopes from the creek up to the city street, and a boardwalk on the street level that overhangs the water. The elevation change would be more dramatic than the San Antonio River Walk, he said.

Midtown has experience developing sizable master-planned projects: it built the 18-square block, 62-acre Midtown Miami city-within-a-city atop the former Buena Vista Rail Yard. It also owns the 22-acre Orlando Sentinel site, which will be a master-planned project.

Midtown hired Morton, who was one of the designers on the city’s original 2016 master plan for the site, created by HKS Architects.

Morton said another key piece to the project will be the 1.5 mile history trail, an “outdoor museum” featuring about 200 places to commemorate people, places and events in history. To help with the historical and equity portions of the project, Midtown partnered with the Rev. Watson Haynes, leader of the Pinellas County Urban League.

Construction would begin on roughly 20 acres east of Booker Creek between First and Third Avenues S. A site where a new baseball stadium could go, between Booker Creek and 16th Street S — roughly where the Trop is now — would be the last to be developed.

Morton said that leaves the team ample time to determine its future, and the proposal acknowledges the uniqueness of the situation: “It is an unusual move to hold the center of a project as the final phase, but this is where the uncertain impact of the Rays is reflected.”

Sugar Hill Commons/Sugar Hill Parks: ‘A once-in-a-generation opportunity’

Developer: Sugar Hill Community Partners, led by San Francisco developer JMA Ventures

Cost: Approximately $3.1 billion in construction costs with a stadium; $2.6 billion without. The proposal calls for $837 million in public funding.

Residences/affordable housing: 2,000-3,200 residential units, with 50 percent designated affordable or workforce housing, and some units reserved for an “artist-in-residence” program.

Office square feet: Two million square feet with a ballpark, 3.1 million without.

Retail square feet: 280,000 square feet with a ballpark; 325,000 square feet without.

Parks and greenspace: With a stadium, it would have 24.3 acres of greenspace, including parks, plazas and some portion of the ballpark’s roof. Its no-ballpark plan has 25.7 acres of green space.

Stadium: If the Rays stay, Sugar Hill proposed a 25,000-seat stadium on the northeast corner of the property, closest to downtown and Central Avenue, with views from nearby buildings akin to Wrigley Field in Chicago. Because that part of the parcel is slightly elevated, the stadium could be dug into ground, which makes access easier for fans.

Hotels and conference space: One 500-room hotel, a 150-room “lifestyle” hotel and a 1.1 million-square-foot convention center.

Research and higher education: Includes a 500,000-square-foot marine science center inspired by AltaSea in Los Angeles, plus 675,000 to 870,000 square feet for a technology campus.

Inclusiveness, equality and racial history: A history walk will run along a pedestrian promenade and connect to existing and planned history trails. A farmers’ market with produce grown at an on-site urban farm targeted specifically toward South St. Petersburg Community Redevelopment Area residents, with learning opportunities for John Hopkins Middle School, Melrose Elementary and Campbell Park Elementary students. Plus a workforce development program through St. Petersburg College.

Arts and culture: Sugar Hill will partner with the St. Petersburg Arts Alliance to create a project-wide art plan and explore the possibility of building a cultural arts center. The proposal also includes partnering with 3 Daughters Brewing to launch a Black-owned brewery. There will be an artist-in-residence program with housing available.

•••

When those behind Sugar Hill Community Partners’ proposal looked at the Trop site, all they saw was a hole.

The Trop site, they said, was a void. While neighborhoods around it — downtown to the east, the Edge District to the north and the Warehouse Arts District to the west — have all blossomed, the 86-acre Trop site remained stagnant. It was within that context, at the nexus of the city’s most rapidly growing and historic communities, that Sugar Hill began its design.

“So first we looked at it as a way to reconnect the community,” said Jordan Behar of St. Petersburg-based Behar Peteranecz Architecture, one of the architects on the project. “Tie together the disparate neighborhoods.”

That starts with enhancing the connection points that exist, like 16th Street and First Avenue S. There will be urban parks underneath those underpasses. And a new pedestrian footbridge doubling as a sculpture garden, with inspiration from Manhattan’s High Line, would swoop over Interstate 175 to connect with Campbell Park.

“You want to make something that was initially a weakness look intentional,” David Carlock, whose firm, Machete Group, is managing the development, said of the highway underpasses.

Among the ways the Sugar Hill proposal stands out is for its enormous, 1.1 million-square-foot convention center. It also proposes an “urban beach” around its expanded Booker Creek design.

The Sugar Hill team includes developers and real estate investors whose projects include Atlanta’s Ponce City Market, San Francisco’s Chase Center, the St. Pete Pier and Water Street Tampa.

Sugar Hill proposes a history walk that would stretch the length of a pedestrian walkway, from the southwest to northeast along the property, creating an X shape with Booker Creek.

The name itself, Sugar Hill, comes from a neighborhood destroyed to make way for the Interstate 175 spur. And the company’s proposal includes working with the African American Heritage Association of St. Petersburg and the Carter G. Woodson African American Museum to come up with historically relevant names for buildings and spaces.

Contact Jay Cridlin at [email protected] or 727-893-8336. Follow @JayCridlin. Contact Josh Solomon at [email protected] or 813-909-4613. Follow @ByJoshSolomon

Attend a listening session on plans to redevelop Tropicana Field site

St. Petersburg is hosting three listening sessions this week, one virtual and two in person. Visit stpete.org/trop for more information and to register.

• Monday, April 5, 6-8:30 p.m., virtual

• Wednesday, April 7, 6-8:30 p.m. at the Coliseum, 535 Fourth Ave. N

• Thursday, April 8, 6-8:30 p.m. at the Coliseum, 535 Fourth Ave. N

:max_bytes(150000):strip_icc():format(webp)/TAL-cheval-blanc-seychelles-hill-villa-SPLURGEITLIST2025-e0c471f11db641b4ac1ec8d51567a015.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-the-emory-rooftop-bar-SPLURGEITLIST2025-3e572d1e92b2489fbbd2e0c5dad0e6ce.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-eriro-exterior-SPLURGEITLIST2025-2a344bb035074688826228a82a2e87a9.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-few-and-far-luvhondo-dining-boma-braai-SPLURGEITLIST2025-8c526cfc8cac4de090e1ffd387bf29e0.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-cabo-san-lucas-SPLURGEITLIST2025-907e07599de94508b683b294952567a0.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-mandarin-lobby-qianmen-hotel-courtyard-SPLURGEITLIST2025-9bf07cff2b604adb9b042b3ef53d2770.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-nekajui-ritz-carlton-reserve-SPLURGEITLIST2025-f0da6230d492474b9542f6edf9362d51.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-nujuma-two-bed-villa-living-room-SPLURGEITLIST2025-14faaec9adde4298bf98a05469572d20.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-ovo-patagonia-SPLURGEITLIST2025-4a28f9afea554fc69128fe0b4a2a9dda.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-saint-peter-island-resport-SPLURGEITLIST2025-474aa04fdfdc4bb283fc231767221bb4.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-the-ranch-hudson-valley-entrance-SPLURGEITLIST2025-978838d23cd74d9f97d9dfa18b171c64.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-soneva-secret-overwater-hideaway-SPLURGEITLIST2025-5721264975a44bf7b67d96b698f6e265.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-st-regis-longboat-pool-aerial-view-SPLURGEITLIST2025-fa3700eba3e9491083e50af16f8dca52.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-voaara-madagascar-SPLURGEITLIST2025-0f7f245866c64e198cdffd3492dd655d.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-wilderness-bisate-SPLURGEITLIST2025-cc9c17c419514b9594cf5d34021c0609.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-aerial-of-resort-REGISLONGBOAT1024-1a30f8fe6c374cfbadc3701f196796c7.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-living-room-suite-REGISLONGBOAT1024-ef2a01915acc4af9b798367ac8a7b957.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-guest-bedroom-REGISLONGBOAT1024-a6f343a810a14e66b783253782541981.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-pool-area-REGISLONGBOAT1024-0c28ab7fe99e4a499395698d9f9720c8.jpg)

:max_bytes(150000):strip_icc():format(webp)/TAL-st-regis-bar-REGISLONGBOAT1024-200dcb789167414ba9c83dfb4acbea2a.jpg)

Chuck Whittall, a prominent figure in Orlando’s development scene, has consistently demonstrated an unwavering commitment to transforming landscapes and enhancing communities.

Chuck Whittall, a prominent figure in Orlando’s development scene, has consistently demonstrated an unwavering commitment to transforming landscapes and enhancing communities.

City Center at O-Town West is a part of Orlando-based Unicorp National Development’s $1 billion O-Town West mixed-use project. (Unicorp National Developments, Inc.)

City Center at O-Town West is a part of Orlando-based Unicorp National Development’s $1 billion O-Town West mixed-use project. (Unicorp National Developments, Inc.)

David Strong took on the role of President and CEO at Orlando Health in 2015. Orlando Health, a prominent private not-for-profit healthcare organization in Florida, manages assets worth $9.2 billion, and more importantly, provides health care services to millions of Central Florida residents.

David Strong took on the role of President and CEO at Orlando Health in 2015. Orlando Health, a prominent private not-for-profit healthcare organization in Florida, manages assets worth $9.2 billion, and more importantly, provides health care services to millions of Central Florida residents. Giuliani is heading into his seventh year as head of the public-private partnership, whose goal is to spread the word that the Orlando area is a great place to do business, while advocating for economic development, public policy and transportation solutions that will draw high-wage companies. Under the OEP’s umbrella are groups ranging from the

Giuliani is heading into his seventh year as head of the public-private partnership, whose goal is to spread the word that the Orlando area is a great place to do business, while advocating for economic development, public policy and transportation solutions that will draw high-wage companies. Under the OEP’s umbrella are groups ranging from the Craig Ustler is the Owner and President of Ustler Development, Inc., a real estate development company, and Vice President of Ustler Properties, Inc., a commercial real estate brokerage company. Ustler is deeply involved in property ownership, investment, development, and brokerage across various sectors including multifamily residential, student housing, hotels, offices, restaurants, retail, and mixed-use.

Craig Ustler is the Owner and President of Ustler Development, Inc., a real estate development company, and Vice President of Ustler Properties, Inc., a commercial real estate brokerage company. Ustler is deeply involved in property ownership, investment, development, and brokerage across various sectors including multifamily residential, student housing, hotels, offices, restaurants, retail, and mixed-use. John Morgan, a prominent figure in the legal world, founded his career on personal injury law due to his brother’s paralysis incident during a heroic lifeguarding effort. With his “For the People” brand and relentless advertising through various mediums, he has ascended to the apex of the legal domain from his Orlando base. Morgan’s battles against corporate giants, advocating for the underdog, have been marked by a 3,000-strong workforce including 488 lawyers across 60 offices. His success, amassing around $500 million or more, led him to support and fundraise for Democratic leaders, as well as collaborate with Republican politicians.

John Morgan, a prominent figure in the legal world, founded his career on personal injury law due to his brother’s paralysis incident during a heroic lifeguarding effort. With his “For the People” brand and relentless advertising through various mediums, he has ascended to the apex of the legal domain from his Orlando base. Morgan’s battles against corporate giants, advocating for the underdog, have been marked by a 3,000-strong workforce including 488 lawyers across 60 offices. His success, amassing around $500 million or more, led him to support and fundraise for Democratic leaders, as well as collaborate with Republican politicians. Pamela Nabors is a driving force behind positive change in workforce development at local, state, and national levels. Nabors leads the region’s official workforce development board, managing a budget exceeding $40 million and a staff of 250. Their team serves 2.8 million residents across five counties: Orange, Osceola, Seminole, Lake, and Sumter. Nabors’ dedication to this field spans decades. Her achievements encompass transformative moments, including pioneering inventive programs that identify talent sources in high-growth sectors and bridge gaps in areas like advanced manufacturing and STEM, scaling up workforce support during the unprecedented challenges of the COVID-19 pandemic, and most recently, aiding employers in navigating historically tough times marked by record-low unemployment, the Great Resignation, and a post-pandemic workforce mindset shift.

Pamela Nabors is a driving force behind positive change in workforce development at local, state, and national levels. Nabors leads the region’s official workforce development board, managing a budget exceeding $40 million and a staff of 250. Their team serves 2.8 million residents across five counties: Orange, Osceola, Seminole, Lake, and Sumter. Nabors’ dedication to this field spans decades. Her achievements encompass transformative moments, including pioneering inventive programs that identify talent sources in high-growth sectors and bridge gaps in areas like advanced manufacturing and STEM, scaling up workforce support during the unprecedented challenges of the COVID-19 pandemic, and most recently, aiding employers in navigating historically tough times marked by record-low unemployment, the Great Resignation, and a post-pandemic workforce mindset shift. Chuck Whittall, a multifaceted personality hailing from Orlando, is renowned for his roles as a visionary developer, inspirational speaker, dedicated philanthropist, and devoted father. His impact is deeply etched into the landscape of the Sunshine State and beyond. At the helm of Unicorp National Developments, a company he founded and currently leads, Whittall’s journey is a testament to the power of ambition, determination, and ethical business practices.

Chuck Whittall, a multifaceted personality hailing from Orlando, is renowned for his roles as a visionary developer, inspirational speaker, dedicated philanthropist, and devoted father. His impact is deeply etched into the landscape of the Sunshine State and beyond. At the helm of Unicorp National Developments, a company he founded and currently leads, Whittall’s journey is a testament to the power of ambition, determination, and ethical business practices. Inez Long serves as the President/CEO of BBIF Florida, a nonprofit Community Development Financial Institution (CDFI) established in 1987. BBIF’s primary focus is offering capital to underserved small businesses, particularly those owned by Black and minority entrepreneurs. The organization’s mission revolves around fostering Black business enterprises through education, training, loans, and advocacy.

Inez Long serves as the President/CEO of BBIF Florida, a nonprofit Community Development Financial Institution (CDFI) established in 1987. BBIF’s primary focus is offering capital to underserved small businesses, particularly those owned by Black and minority entrepreneurs. The organization’s mission revolves around fostering Black business enterprises through education, training, loans, and advocacy. With a rich blend of Mexican, Puerto Rican, Dominican, and Floridian heritage, Gaby Ortigoni has dedicated two decades to serving the Hispanic community of Central Florida. As the President of HCCMO (Hispanic Chamber of Commerce of Metro Orlando), her role entails ensuring the Chamber dutifully meets its obligations to its members. Ortigoni’s professional journey has been marked by unwavering commitments spanning business development, strategic relationship cultivation, economic growth, international trade, government affairs, and holistic community progress.

With a rich blend of Mexican, Puerto Rican, Dominican, and Floridian heritage, Gaby Ortigoni has dedicated two decades to serving the Hispanic community of Central Florida. As the President of HCCMO (Hispanic Chamber of Commerce of Metro Orlando), her role entails ensuring the Chamber dutifully meets its obligations to its members. Ortigoni’s professional journey has been marked by unwavering commitments spanning business development, strategic relationship cultivation, economic growth, international trade, government affairs, and holistic community progress. Martha McGill, President of Central Florida Region and a member of Nemours’ Florida Executive Cabinet, has been part of Nemours since 2015. Beyond overseeing hospital operations, she spearheads the establishment and integration of Nemours’ practice sites and partnerships throughout Florida. McGill manages a range of sectors, including Florida’s Network Operations Chief Medical Officer, Service Delivery and Innovation, Strategy and Business Development, Physician and Patient Network Operations, and Practice Administration.

Martha McGill, President of Central Florida Region and a member of Nemours’ Florida Executive Cabinet, has been part of Nemours since 2015. Beyond overseeing hospital operations, she spearheads the establishment and integration of Nemours’ practice sites and partnerships throughout Florida. McGill manages a range of sectors, including Florida’s Network Operations Chief Medical Officer, Service Delivery and Innovation, Strategy and Business Development, Physician and Patient Network Operations, and Practice Administration.

:max_bytes(150000):strip_icc():format(webp)/TAL-tao-hotel-TAO1122-c5ee489d18964e1aa6888f9704254905.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/HQRKHLRBGFFV5OINQJU757IKVY.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/LPCOG3XHP5GSJFOXOPPC2NSFSI.jpg)